Empower yourself to achieve debt freedom. We'll guide you with personalized strategies, powerful tools, and professional expertise every step of the way.

Debt can feel like swimming with weights tied to your ankles. Every monthly payment pulls you down, leaving less room to save, invest, or enjoy the life you’re working so hard for. But here’s the good news: with the right plan, you can drop the dead weight, build momentum, and start shaping a future of freedom and financial security.

Let’s walk through the smartest strategies to pay off debt—and how you can create your own clear path to wealth and a better retirement.

What’s the Best Way to Pay Off Debt?

The “best” way depends on your situation, but these proven methods can help you decide:

Snowball Method – Pay off your smallest debt first while making minimum payments on the rest. Each win builds motivation, and soon your payments snowball into faster results.

Avalanche Method – Focus on your highest-interest debt first. It may take longer, but you’ll save more money in the long run.

Combination Method – Start small for quick wins, then switch to tackling high-interest debt once you gain momentum.

No matter which strategy you choose, consistency is key. The right plan is the one you can stick with over the long term.

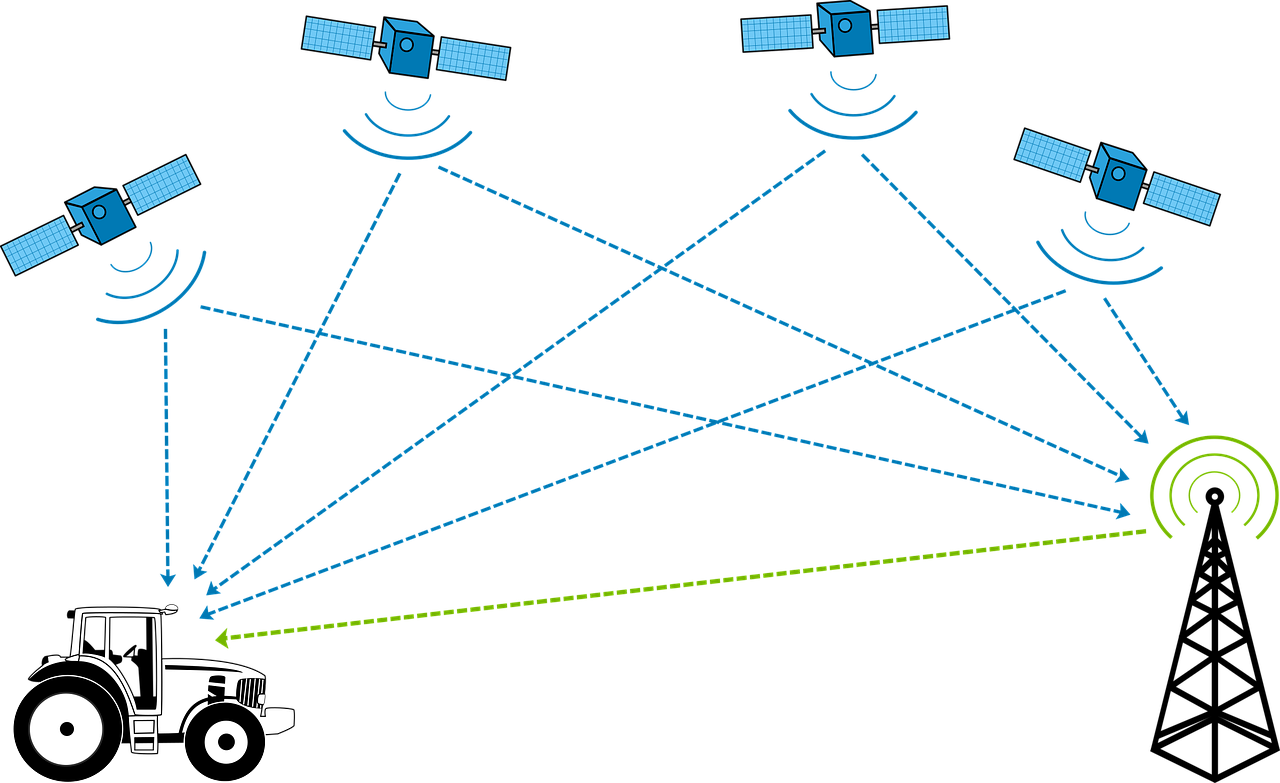

Using a Financial GPS

Managing multiple debts can be overwhelming. That’s why having a system that works like a financial GPS is a game changer.

Just like your phone maps out the fastest route to your destination, a financial GPS helps you chart the quickest way to debt freedom. It constantly adapts to changes in your income, expenses, and goals, giving you clear steps forward. Instead of guessing, you’ll always know the most efficient route to becoming debt-free.

Should You Work with a Planner?

Absolutely. A professional can help you design a plan that balances today’s needs with tomorrow’s goals. But even if you’re not ready to sit down with an advisor, having the right tools and guidance can keep you moving in the right direction.

Putting It All Together

Your debt-free journey can start today with a few simple steps:

List your debts, interest rates, and payments.

Set a realistic budget that balances essentials with debt payoff.

Pick a strategy (snowball, avalanche, or combination) that fits your style.

Use tools—or a financial GPS system—to keep you on track.

Stay consistent and celebrate small wins along the way.

Remember: debt freedom isn’t just about paying less interest. It’s about creating more space for the life you want to live—retirement without financial stress, more time with family, and the ability to truly enjoy your hard-earned wealth.